[ad_1]

Changing fitness behaviors just one of many 2021 health trends informed by Murphy Research’s State of Our Health comprehensive food and fitness tracker

Many research studies focus on food or fitness, but Murphy Research’s State of our Health is the only ongoing syndicated study that examines both and their interconnectivity, which provides for a more comprehensive and accurate picture of consumer health and wellness trends.

SANTA MONICA, Calif. (PRWEB)

December 15, 2020

Murphy Research, a 10-year-old leading market research firm known for creative research design, rigorous execution and enduring insights, today released its top 10 fitness and food trends for 2021. The trends are derived from Murphy Research’s State of Our Health (SOOH) syndicated study, the largest and most comprehensive ongoing food and fitness tracker in the U.S. These trends clearly show the enduring impact COVID-19 will have on many aspects of health and wellness in the new year, with “new normals” being created in several categories, and extended recovery times from pandemic-related behaviors.

Since 2018, SOOH has been continuously collecting data from 1,000 U.S. consumers aged 13 and up each month, providing for in-depth insights over time that uniquely examine trends that lie at the intersection of fitness and food. The vast amount of information collected through SOOH allows for exceptionally clear insights into how COVID-19 continues to impact almost every facet of American health- and wellness-related behaviors, and informed the following 2021 food and fitness trend predictions:

- Trend One: The new year will bring a LOT of resolutions, especially for Gen Z. Living through months in a pandemic has left many consumers saddled with less-than-healthy habits, extra weight, and reduced physical activity, as well as an almost desperate desire to put this year behind them and start fresh. This will likely lead to an influx of New Year’s resolutions heading into 2021, especially for younger people who are more likely to make resolutions. In particular, Gen Z ended 2020 giving themselves lower performance grades on almost every personal priority than they did at the beginning of the year, including improving mental health, personal relationships, fitness, and appearance – classic resolution areas. More detailed resolution data will be available in early 2021 via Murphy Research’s annual resolutions survey, which is part of the overall SOOH study.

- Trend Two: Detoxing 2020 will become a theme. Unsurprisingly, engagement in socially-oriented aspects of food and fitness has declined throughout 2020. Appearance has become less important, as has losing weight, meeting people through fitness, and more. All of this will come roaring back with a vengeance once we’re able to see and be seen again. As a result, expect a surge of interest in cleanses, diets, and exercises that promise quick results as consumers seek to “reset” their systems as we get ready for more face time and less screen time.

- Trend Three: Online grocery shopping is here to stay, kind of. Online grocery ordering and delivery became much more important this year for Boomers and women, previous online ordering holdouts. Among women, online ordering increased in importance by 7 percentage points compared to 2019, and delivery by 6 percentage points. Among Boomers, the importance of online ordering increased almost 10 percentage points from the beginning to the end of the year. In 2021, many consumers will likely keep shopping online, but may be hesitant to pay delivery fees, especially for small trips. Online retailers and grocers who’ve adapted to online shopping will need to prepare for this price sensitivity.

- Trend Four: Immunity takes center stage. Supporting immune health has become a key motivation for many food and fitness behaviors in 2020, but particularly when it comes to vitamins and supplements. Between 2019 and 2020, consumers of these products reported an 11 percentage point increase in taking vitamins and supplements to support their immune systems, while most other motivations stayed relatively stable. Where trend-setters are looking to novel ingredients like mushrooms, adaptogens and probiotics, mainstream consumers just want immune support as a functional benefit. This claim is likely to have increased salience into 2021, and can be expected to be everywhere.

- Trend Five: Women are in for a longer post-pandemic recovery period. The pandemic has been harder on women in many ways, including large swings in health engagement. In March, 39 percent of nutritionally-engaged women were on a formal food plan. By May, this number dropped by more than 10 percentage points and has never recovered. Men, on the other hand, have been more likely to stick to eating plans in 2020, suggesting that men and women are coping differently with the pandemic. As a result, recovery from 2020 will likely take longer and be more difficult for women. This will probably look like more fitness and nutrition engagement ups and downs and decreased feelings of motivation around health goals.

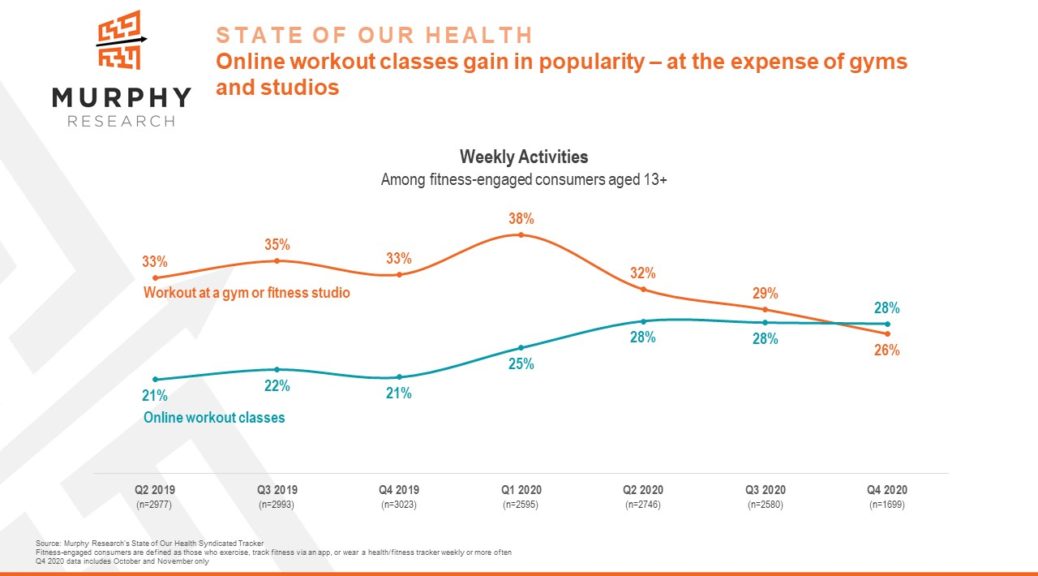

- Trend Six: Online fitness or gym? Both, please. The pandemic prompted fitness-engaged consumers to find new ways to get their fix, and online fitness was it. Data suggests this is no flash in the pan. But, there’s a catch. Online fitness users are also more likely to be gym members. This means that, while online fitness is here to stay, it’s likely to shift toward occasions and activities that are complements to the gym rather than replacements once gyms open again in 2021.

- Trend Seven: But, only some former gym rats will return to the gym, and not (only) because of online fitness. COVID-19 lasted long enough that former gym buffs who could build a home gym did it. These were gym regulars who are unlikely to return. This group is mainly older, more well-off exercisers because building a home gym takes space and money. Most Millennials don’t have either, so they’ll return to the gym once it’s safe to do so, along with exercisers who are social, competitive and seek variety.

- Trend Eight: Mental health and exercise become more aligned. Interest in exercise as a mental health strategy is spreading from younger consumers to older ones, along with yoga and meditation for stress relief. While younger generations, who already are more likely to do things like meditate and journal, remained steady in their activities, Gen X began to take their cue. Gen Xers who do weekly yoga for mindfulness increased by 7 percentage points in 2020, as did the number who report journaling for mindfulness or gratitude. The number of consumers in this group who meditate has also been increasing.

- Trend Nine. Health as a hobby is poised to make a return in summer. In March, 27 percent of consumers were reading health-related content or talking to others about diet on a weekly basis. In June, this dropped to 20 percent and has stayed low. As pandemic news coverage dominated, it took away the pleasure many health-engaged consumers previously got from keeping up with health news, particularly among Gen X and Boomers, who saw even steeper declines. This interest is expected to quickly shift back to “normal” with the vaccine. Consumers will crave inspiration and guidance as they deal with the fallout from 2020.

- Trend Ten. Wellness-related spikes and crashes are expected well into 2021. The first wave of the pandemic prompted a huge increase in wellness-related behaviors, from exercise to dieting to meditation. This was followed by a crash in those same behaviors that lasted for months. This roller-coaster pattern continued with subsequent COVID-19 surges and is expected to continue in early 2021 with lofty health aspirations followed by an extended crash that will continue until widespread vaccination.

“A lot of research studies focus on food or fitness, but SOOH is the only ongoing syndicated study that examines both and their interconnectivity, which provides for a more comprehensive and accurate picture of consumer health and wellness trends,” said Chuck Murphy, founder and president of Murphy Research. “This unique approach, combined with ongoing robust quantitative and qualitative data collection, points to 2021 trends that redefine what were routine approaches to health and wellness prior to the pandemic.”

SOOH is the standard reference point for uncovering the underlying truths and trends that propel people’s food and fitness attitudes and behaviors. The concept for SOOH was born from Murphy Research’s cutting-edge custom research with category-leading consumer brands like Gatorade, Nike and Athleta. This work demonstrated the powerful insights derived from examining food and fitness together. Murphy Research recognized the need for an ongoing, far-reaching syndicated study that could better answer questions about consumer health behaviors and trends than was achievable by exploring food or fitness in isolation and during a snapshot in time. Today, SOOH is the only syndicated tracker examining both food and fitness, and how the two are related. To date, more than 35,000 consumers have participated in the 45-minute SOOH questionnaire, providing both incredible breadth and unparalleled depth. SOOH employs gold standard quantitative and qualitative research methods informed by decades of experience.

About Murphy Research

Murphy Research is a full-service market research firm that understands groundbreaking research lies at the intersection of science and creativity. Based in Santa Monica, but with offices in Dallas, Chicago, Minneapolis and Washington D.C, the firm is known for its creative research design, rigorous execution and enduring insights. Murphy Research offers quantitative and qualitative services to help clients with market assessment, brand strategy, product development, customer loyalty and engagement and communications research. The firm works with leading Fortune 500 companies, like PepsiCo, Sony, YouTube, Disney and Google, among many others, along with emerging technology, CPG, retail, media, communications and financial services organizations.

Share article on social media or email:

[ad_2]