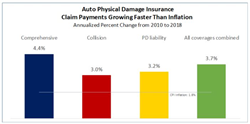

Auto Damage Claims Grow Faster Than Inflation from 2010-2018

As vehicle technology continues to evolve, understanding the cost drivers behind auto physical damage claims will be important in addressing issues in auto insurance availability and affordability.

MALVERN, Pa. (PRWEB)

December 01, 2020

A new study from the Insurance Research Council (IRC) finds that the average payment for auto physical damage insurance claims increased at more than double the rate of inflation from 2010 through 2018. The study, which examines patterns in private passenger comprehensive, collision, and physical damage liability insurance claims, found that average claim payments increased 3.7 percent annualized during the study period, while the overall Consumer Price Index (CPI), as well as the CPI for motor vehicle maintenance and repair, grew 1.8 percent annualized. The study also finds that while the average age of the private passenger auto fleet has increased, growth in the claim costs for newer vehicles has been particularly rapid, fueled by the increasing cost of replacing parts in more advanced vehicle technology.

Some of the other findings from the study include:

- Total losses have become more common and more expensive.

- Catastrophe claims accounted for about one in five dollars paid for comprehensive claims.

- Deductibles and policy limits have not kept pace with the growth in payments.

- Physical damage claims have become less likely to have associated injury claims.

- The rate of attorney involvement is lower in physical damage claims than in auto injury claims.

- For most aspects of physical damage claims, there are significant differences among states.

“Damage to vehicles accounts for a growing share of the costs of paying auto insurance claims,” said David Corum, CPCU, vice president of the IRC. “As vehicle technology continues to evolve, an understanding of the cost drivers behind auto physical damage claims will be important in addressing issues in auto insurance availability and affordability.”

The report, Patterns in Auto Physical Damage Insurance Claims, presents findings from a collection of more than 220,000 claims closed with payment under the three principal private passenger auto physical damage coverages in claim years 2010, 2014, and 2018. Participating insurers accounted for more than half of the private passenger auto insurance market. For more information on the study’s methodology and findings, contact David Corum at (484) 831-9046 or by email at IRC@TheInstitutes.org.

###

NOTE TO EDITORS: The Insurance Research Council (IRC) is a division of The Institutes, the leading provider of risk management and insurance knowledge solutions. The Institutes offer professional and associate designations, including the CPCU® program, along with introductory, foundation, and leadership programs; online and continuing education courses; custom solutions; assessment tools; and industry consortia. The IRC provides timely and reliable research to all parties involved in public policy issues affecting insurance companies and their customers. The IRC does not lobby or advocate legislative positions. It is supported by leading property-casualty insurance organizations.

CPCU is a registered trademark of The Institutes. All rights reserved

Share article on social media or email: