“Car insurance quotes can help drivers find the best insurance policy for them. Insurance providers will determine the cost of a policy after applying several factors..”, said Russell Rabichev, Marketing Director of Internet Marketing Company.

LOS ANGELES (PRWEB)

February 15, 2021

Compare-autoinsurance.org has launched a new blog post that presents some of the most important pieces of information everyone should know about car insurance quotes.

For more info and free car insurance quotes, visit https://compare-autoinsurance.org/car-insurance-quotes-online-explained/

Most first-time car owners can feel overwhelmed when shopping for car insurance. Luckily, car insurance quotes can help them outline the types of coverage a policy offers and how much they can expect to pay. Car insurance quotes are estimates, based on the car owner’s personal information, of how much a provider will charge on an insurance policy. Because premiums vary across insurers, quotes are very important. To avoid paying too much on an insurance policy, drivers should compare as many quotes as possible. Also, drivers looking to buy a new car should get quotes based on the car they want to get. Furthermore, drivers who are not satisfied by their current provider can also get quotes to find a new carrier that suits their needs.

When determining car insurance premiums, providers use different factors such as:

- Age. Older, more experienced drivers cause fewer accidents and are charged less on their insurance rates. Usually, young drivers under 25 pay the highest car insurance premiums.

- Gender. Statistically, men are more likely to be involved in an accident. For this reason, car insurance companies charge more on male drivers.

- Credit. In most states, car insurance companies are allowed to use the driver’s credit score as a factor to determine the premiums. Statistically, drivers who have a poor credit score are more likely to file car insurance claims. For this reason, they pay more on insurance. On the other hand, drivers with excellent credit score and clean driving records are more likely to receive better deals on their premiums

- Driving record. Policyholders who have a history of at-fault accidents and traffic violations pose a higher financial risk for insurance providers. To lower their risk, insurance companies will charge more on the premiums of drivers with poor driving history.

- Address. The place where a driver lives can impact the insurance rates for several reasons. Drivers living in bad neighborhoods where car thefts and vandalism are often will pay more on their insurance. Furthermore, drivers living in a city where there is a high rate of traffic accidents per capita can also expect to be charged more by their carriers.

- Make and model of car. Drivers who are driving electric, luxury, sports, or exotic cars will pay more on their insurance because these types of vehicles cost more to repair or to replace. On the other hand, used family cars, minivans, or popular SUV models cost less to insure.

- Mileage. Drivers who are using their cars to drive frequently are more likely to be involved in accidents and to file insurance claims. To pay less on their premiums, drivers should avoid driving too often.

- The type of policy and coverage. Some drivers who own older vehicles choose to purchase only the state minimum insurance required by the law. However, drivers who lease or finance their vehicles are required by their lenders or leasing agents to get full coverage. Furthermore, besides having full coverage, some policyholders add optional coverages to be better covered against different situations.

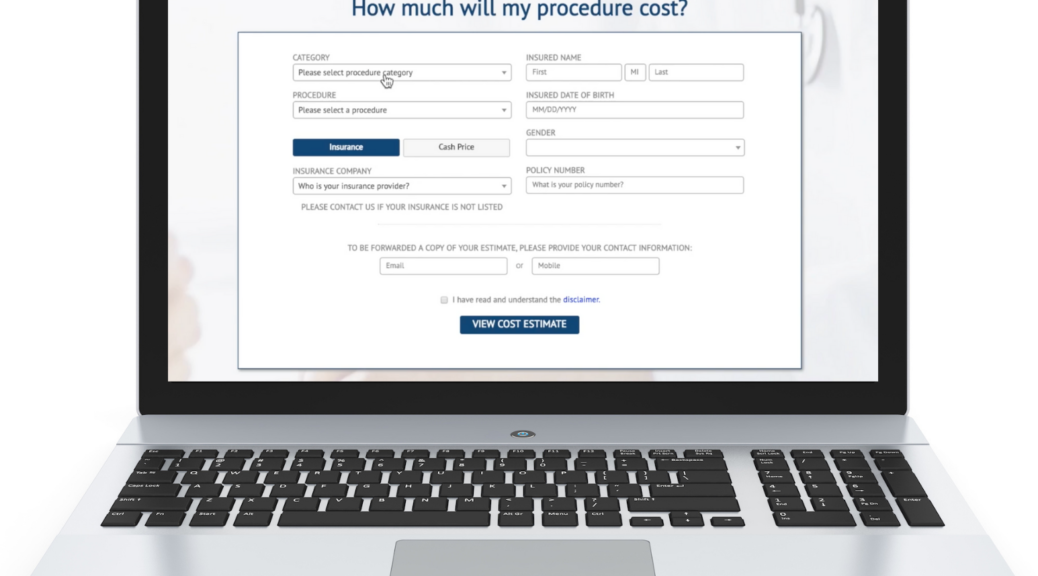

Drivers looking to get insurance quotes can do so in the office of a local agency of a national insurance carrier, like Allstate, Geico, or State Farm. Drivers can also request quotes via phone or they can get them online. Most major insurers have websites that offer online quotes where drivers will need to give details such as name, address, age, gender, location, vehicle type, how they use the vehicle, and how much they drive, to get quotes. Some insurance providers will even allow drivers to get insurance policies at the end of the quote process.

The insurance policies are sold by agents who work directly with an insurance company or by agents who work independently and can offer multiple quotes from different providers, without having to visit several agencies.

For additional info, money-saving tips and free car insurance quotes, visit https://compare-autoinsurance.org/

Compare-autoinsurance.org is an online provider of life, home, health, and auto insurance quotes. This website is unique because it does not simply stick to one kind of insurance provider, but brings the clients the best deals from many different online insurance carriers. In this way, clients have access to offers from multiple carriers all in one place: this website. On this site, customers have access to quotes for insurance plans from various agencies, such as local or nationwide agencies, brand names insurance companies, etc.

Share article on social media or email: