Murphy Research releases nine health and wellness trends for 2022

As COVID-19 rages on, it’s becoming clear that short-term adjustments to food, fitness, and mindfulness routines many Americans made in early 2020 are becoming established trends and habits

SANTA MONICA, Calif. (PRWEB)

December 07, 2021

Murphy Research, a leading market research firm known for creative research design, rigorous execution and enduring insights, today released nine food, fitness, health and wellness trends for 2022. The trends come from Murphy Research’s State of Our Health (SOOH) syndicated study, the largest and most comprehensive food, fitness, and mindfulness tracker in the U.S. These trends highlight the ongoing volatility caused by COVID-19, and its impact heading into an uncertain 2022.

SOOH has been continuously collecting data since 2018, with a current sample size of more than 40,000 U.S. consumers aged 13 and older. This ongoing, robust and rich data set has clearly captured the enduring effects of COVID-19. The following food, fitness, and mindfulness trends informed by SOOH are poised to characterize consumer health and wellness in 2022:

1. Healthy eating and exercise will move from aspiration to action, but only among those who already cared

Despite the many challenges of the pandemic, a propensity toward healthy eating that began in 2020 has continued to grow. Since 2019, nutrition engagement has increased from 69% of the population to 73%, a small but significant difference equating to approximately 11.9 million more Americans actively eating healthier now than two years ago. But, diet isn’t the whole story. These newly nutrition-conscious consumers were already exercising; meaning more Americans have moved from being solely concerned about fitness to engaging with both exercise and diet since the start of the pandemic. In other words, consumers who were already engaged with health actually have become more engaged, turning aspirations into real action. Looking ahead to 2022, this trend suggests that although the total health and wellness market size has not changed, the level of investment consumers are willing to put in has grown.

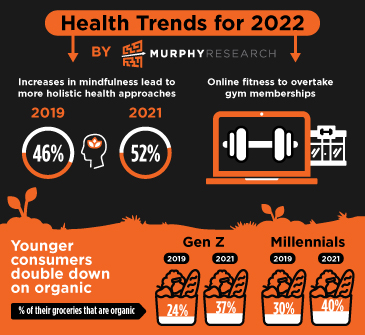

2. Mindfulness will shift from short-term concerns to long-term health goals

Engagement with mindfulness grew throughout both 2020 and 2021. Between Q3 2019 and Q3 2021, the number of Americans with a weekly mindfulness practice increased from 46% to 52%. This growth likely means a continued shift from short-term concerns, like losing weight or looking good, toward long-term goals around wellness, holistic health and living one’s values. Additionally, people who practice mindfulness invest more across all fitness and nutrition categories than other consumers, and they are more likely to prioritize sustainability and corporate responsibility in their purchasing decisions. Food, fitness, and wellness brands that are able to successfully court these highly engaged, holistic-thinkers could experience incremental growth in 2022.

3. Millennials will prioritize health and wellness over work and financial success

The pandemic forced many consumers to reassess their priorities. Millennials in particular show a distinctive change in prioritizing overall wellness, including not only mental and physical health, but also work-life balance. Relative to the previous year, in 2020 and again in 2021, significantly more Millennials reported exercising, tracking their health and wellness habits, engaging in mindfulness behaviors, researching health topics, talking with dietary experts and following formal food plans. No other generation showed year over year increases in all of these areas. Based on these shifts, it’s not surprising that Millennials now rank work-life balance as their fifth highest personal priority, up from ninth place in 2019. Already a trendsetting generation with a distinctive approach to healthy eating and fitness, Millennials are entering 2022 having made real and lasting investments in wellness and, more importantly, shifts in priorities they are determined to act on. This means that Millennials will give an even greater share of their dollars to health-forward products and services that align with their values.

4. Exercising habits will remain inconsistent

Seasonal engagement with fitness has fluctuated dramatically throughout 2021, with higher highs and lower lows than trended pre-pandemic. Before COVID-19, fitness engagement peaked early in the summer and slid slowly and steadily downhill toward December. But 2021 has been a continuation of 2020’s roller-coaster shifts, indicating that Americans still haven’t found an equilibrium since the pandemic interrupted their fitness habits. This trend is true even of Boomers, who tend to be the steadiest demographic in terms of health habits. Next year will likely continue to be chaotic as fitness consumers and businesses both try to establish a new normal.

5. Young men will get some company at the gym

As of Q3 2021, 33% of fitness-engaged Americans had gym memberships, the same percentage as prior to the pandemic in 2019. However, these new gym members are quite different from those in 2019. Currently, 56% of gym members are 40 or under, compared to 46% in 2019. The share of Boomers dropped from 31% to 22%, and 55% of gym members today are men, compared to an even split in 2019. Put simply, women, Gen X, and Boomers left the gym early in the pandemic and haven’t returned in the same numbers. They also haven’t replaced it with online fitness, which tends to also skew younger and male. However, this is expected to change in 2022 if COVID-19 becomes endemic. These groups will look to return to the in-person exercise they put on hold during the pandemic, but they may find that their old gyms are now set up for the younger men that have been frequenting gyms during the pandemic, a potentially intimidating social mix. This means that gyms and studios need to balance catering to their current members without putting all their eggs in that one basket if they hope to bring back former regulars.

6. Online fitness will overtake gym memberships but they aren’t necessarily in competition

Gym memberships may have rebounded to 2019 levels, but online fitness participation increased even as consumers returned to gyms, growing from 11% in 2019 to 20% in 2020, and 24% in 2021 among fitness-engaged Americans. Assuming gym memberships remain steady, the number of Americans who participate in online fitness will surpass the number with gym memberships in the next year. However, it’s not a competition. Close to 70% of those who regularly use online fitness are also gym members. These consumers are fitness trendsetters. They use online fitness as simply one other fitness resource, and they actually use it at the gym just as often as they use it at home. Online fitness is a complement, not a competitor, to the gym. However, when gym members turn to online fitness for guidance, inspiration and tracking, it could mean not turning to in-person staff and trainers. In 2022, gyms and online fitness brands would be wise to work synergistically. In particular, in-person brands that neglect the virtual may quickly find themselves out in the cold.

7. Women will continue to cook at home

Women changed their cooking and meal sourcing behaviors during the pandemic more so than men, and these habits seem to be turning into enduring trends. Women stopped dining out early in the pandemic and bridged the gap almost entirely with cooking at home, while men looked to other types of outsourced meals, like takeout/delivery, frozen or packaged fresh meals from grocery, to make up the difference. These trends started during the pandemic, but have continued through 2021 even as consumers have been returning to restaurants. In Q3 2021, 52% of men reported dining out weekly or more, an increase of 12 percentage points from Q3 2020, and higher than Q3 2019’s 49%. Only 33% of women did the same in Q3 2021, an increase of only 4 percentage points from Q3 2020, and still well below Q3 2019’s 41%. While women will certainly come back to restaurants in 2022, the value equation that women consider when dining out has changed for the long-term. They now have established shopping and cooking habits, recipes, and skills to deal with situations that might have been occasions to dine out pre-pandemic. This ongoing trend for restaurants is a boon for home-focused food brands, which are likely to see strong sales and engagement, especially given ongoing disruption in the restaurant sector.

8. Younger consumers will double down on organic

Younger consumers have been driving growth in organic for several years, but the pandemic continues to accelerate this trend. Across all nutrition-engaged consumers, the percentage who report that half or more of their groceries are organic increased from 19% in 2019 to 24% in 2020, where it has remained. However, in 2021 Gen Z reports that 37% of their groceries are organic, compared to 24% in 2019, and among Millennials it’s 40% in 2021 vs 30% in 2019, both dramatic increases. This is likely a long-term shift that was given an extra push by the pandemic. Rather than growing out of their “foodie” tendencies, or getting a reality check at the checkout counter, Millennials and Gen Z are doubling down on their values at the grocery store. Expect their commitment to organic to grow in 2022.

9. Millennials will say no to meat in larger numbers

More Millennials are avoiding purchasing meat and opting for plant-based alternatives, and one in five is eating a vegetarian or vegan diet – 33% more than in 2020. In Q3 2021, 55% of Millennials reported having bought fresh meat in the past three months, compared to 66% in Q3 2020, while the number buying any type of alternative meat or dairy increased from 61% in Q3 2020 to 70% in Q3 2021. While most alternative meat/dairy purchasers also buy meat and dairy, the balance is shifting, at least at grocery. In 2022, not only will consumers, especially Millennials, be looking for more products that fit a plant-based lifestyle at grocery and at restaurants, it also represents a paradigm shift in what a “healthy diet” includes, with ramifications for meat and dairy certainly, but also any brand in the protein space.

“As COVID-19 rages on, it’s becoming clear that short-term adjustments to food, fitness, and mindfulness routines many Americans made in early 2020 are becoming established trends and habits,” said Chuck Murphy, founder and president of Murphy Research. “Due to its ongoing nature and data set that spans the past four years, including since before the start of the pandemic, SOOH is uniquely positioned to identify these types of food, fitness, and mindfulness trends that are shaping important aspects of American culture and informing a variety of health-related brands.”

SOOH is the standard reference point for uncovering the underlying truths and trends that propel people’s food, fitness and mindfulness attitudes and behaviors. The concept for SOOH was born from Murphy Research’s cutting-edge custom research with category-leading consumer brands like Gatorade, Nike and Athleta. This work demonstrated the powerful insights derived from examining food, fitness and mindfulness together. Today, SOOH is the only syndicated tracker examining how these three important aspects of health and wellness are related. To date, more than 40,000 consumers have participated in the 30-minute SOOH questionnaire, providing unparalleled data breadth and depth. SOOH employs gold standard quantitative and qualitative research methods informed by decades of experience.

About Murphy Research

Murphy Research is a full-service market research firm that understands groundbreaking research lies at the intersection of science and creativity. Based in Santa Monica, but with offices in Dallas, Minneapolis, Seattle, and Washington, D.C, the firm is known for its creative research design, rigorous execution and enduring insights. Murphy Research offers quantitative and qualitative services to help clients with market assessment, brand strategy, product development, customer loyalty and engagement, and communications research. The firm works with leading Fortune 500 companies, like PepsiCo, Sony, YouTube, Disney, and Google, among many others, along with emerging technology, CPG, retail, media, communications, and financial services organizations. In addition to custom research, Murphy Research’s comprehensive State of Our Health (SOOH) syndicated food and fitness tracker provides brands with comprehensive and ongoing data uncovering the underlying truths that propel health and wellness attitudes and behaviors.

###