Our SaaS-based approach of offering ongoing software version updates provides for continuous functionality improvement so that our clients can focus on managing their investments and not managing upgrades.

GREENWICH, Conn. (PRWEB)

August 10, 2021

INDATA, a leading industry provider of software, technology and managed services for buy-side firms, today announced a software release providing enhanced functionality and productivity improvements.

Highlights include:

-

Enhanced trade tools for multi-asset investment strategies - New OMS features offering greater efficiency in working with orders/executions

- Additional compliance look-throughs spanning real-time, pre-trade and post-trade checks throughout the trading life cycle

- Greater alerting/tracking features in terms of system monitoring/usage for compliance and operations professionals

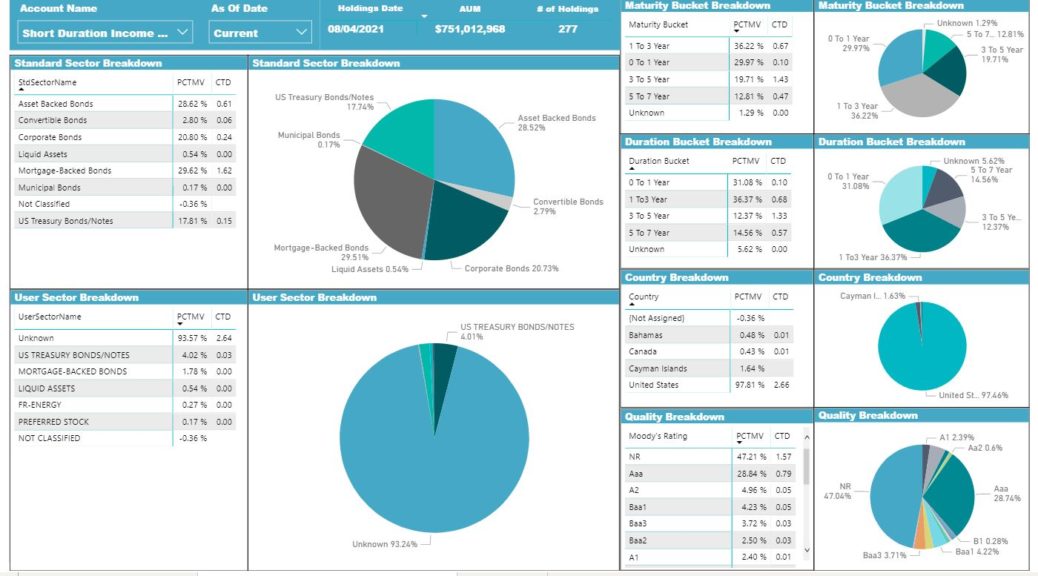

- New and improved dashboard tiles within iPM Portal offering fully customizable information to end clients

- Streamlined trade settlement dashboards with leading industry providers

- Additional performance measurement options offering increased granularity for calculating rates-of-return and attribution

- Expanded ALGO connectivity with leading brokers and automated, exception-based reconciliation with leading custodians

- New Reports and Data Visualizations within key areas of the system

In addition, INDATA offers built-in BI (Business Intelligence) Reporting, providing clients with a complete tech platform for analyzing and reporting on data across the organization, with the ability to aggregate data from both internal and external sources. For firms looking to benefit from the emerging field of data science to optimize investment performance, Architect AI Data Analytics offers an out-of-the-box solution that is fully integrated and which can implemented as a managed service.

“Our SaaS-based approach of offering ongoing software version updates provides for continuous functionality improvement so that our clients can focus on managing their investments and not managing upgrades,” commented David Csiki, President of INDATA. “In addition, our clients benefit from receiving the latest tech tools as they become available and fit for purpose, an important competitive advantage,” he added.

About INDATA®

INDATA is a leading specialized provider of software, technology and managed services for buy-side firms, including trade order management (OMS), compliance, portfolio accounting and front-to-back office delivered via iPM Epic® – the industry’s first investment technology platform specifically designed for the era of big data and iPM Portfolio Architect AI™, the industry’s first portfolio construction, modeling, rebalancing and reporting tool based on AI and Machine Learning. INDATA’s iPM – Intelligent Portfolio Management® technology platform allows end users to efficiently collaborate in real-time across the enterprise and contains the best of class functionality demanded by sophisticated institutional investors. The company’s mission is to provide clients with cutting edge technology products and services to increase operational efficiency while reducing risk and administrative overhead.

INDATA provides software and services to a variety of buy-side clients including asset managers, registered investment advisors, banks and wealth management firms, pension funds and hedge funds. Assets under management range from under $1 billion to more than $100 billion across a variety of asset classes globally. For more information, visit http://www.indataipm.com or follow us on Twitter: @indataipm and LinkedIn.

Share article on social media or email: