“Credit score has become a very important rating for many insurance providers. Improving or keeping the score at Good to Excellent values will only help you save money on auto insurance and provides more benefits to other financial activities” said Russell Rabichev, Marketing Director

Los Angeles, CA (PRWEB)

March 28, 2020

Compare-autoinsurance.org has released a new blog spot that highlights the importance of credit score in determining auto insurance premiums.

For more info and free car insurance quotes online, visit http://compare-autoinsurance.org/credit-score-and-insurance-rates/

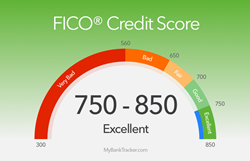

Amongst the many factors used to create a risk profile for their customers, insurance companies take into consideration credit score. This factor tells the companies how likely you are to pay your premiums. Since it is a risk-based business, the ability to repay your debts becomes critical.

-

There are few states where legislation forces insurance companies not to take into consideration credit score when rating a potential customer. In California, Massachusetts, and Hawaii using credit score as a rating factor is illegal. Otherwise, it will impact costs. To find out more about how car insurance rates are determined, you can visit http://compare-autoinsurance.org. - Naturally, drivers will poor FICO score will have to pay more for car insurance, in order for the companies to compensate for the increased risk. Also, many companies claim that there is a correlation between credit score and the chances of making a claim. According to them, people with a poor credit score are not that capable of handling finances and are more likely to ask for reimbursement when accidents happen. They will even ask money for a minor accident which would otherwise be paid from personal finances by responsible persons.

- Drivers with a poor score, 524 or below, will pay twice or more for car insurance when compared with a driver of similar profile, but with an excellent credit score. Credit score can be improved over time, with each improved tier saving on average 17% on annual premiums.

- Improving the credit score from poor to good, can save 32% on insurance premiums. Improving the credit score from good to excellent can save an additional 27% on car insurance rate.

Compare-autoinsurance.org is an online provider of life, home, health, and auto insurance quotes. This website is unique because it does not simply stick to one kind of insurance provider, but brings the clients the best deals from many different online insurance carriers. In this way, clients have access to offers from multiple carriers all in one place: this website. On this site, customers have access to quotes for insurance plans from various agencies, such as local or nationwide agencies, brand names insurance companies, etc.

For more information and money-saving tips, please visit https://compare-autoinsurance.org

Share article on social media or email: