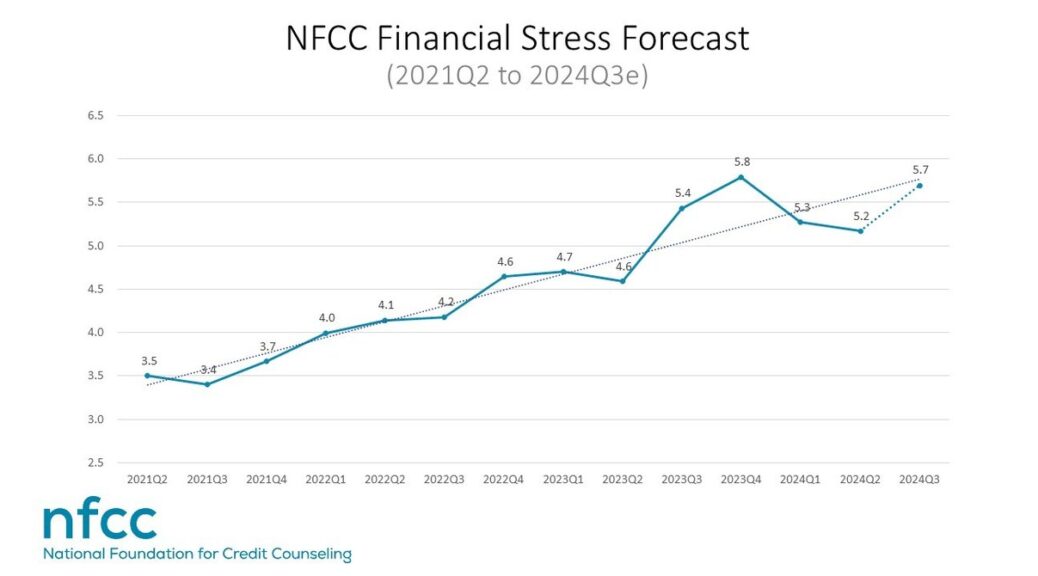

“The numbers don’t lie,” said Mike Croxson, CEO of the NFCC. “We’re witnessing a perfect storm of economic pressures pushing consumers to their limits. The rapid acceleration of financial stress in such a short period is unprecedented and demands immediate attention.”

It’s important to note that the NFCC’s data are derived from individuals seeking counseling, suggesting that the overall level of financial stress is likely even higher within the population at large.

“Time is not your friend if you are struggling to pay your creditors,” Croxson continued. “We urge anyone feeling overwhelmed by debt to seek help immediately. Nonprofit credit counseling can provide essential guidance and support to navigate these challenging times.”

The NFCC Financial Stress Forecast serves as a critical early warning indicator of potential economic instability. As consumer financial health deteriorates, it can have far-reaching consequences for the broader economy, including increased loan defaults and economic slowdown. For more details, email [email protected].

About NFCC

Founded in 1951, the National Foundation for Credit Counseling (NFCC) is the oldest nonprofit dedicated to improving people’s financial well-being. With a growing network of NFCC Certified Credit Counselors serving 50 states and all U.S. territories, NFCC nonprofit counselors are financial advocates, empowering millions of consumers to take charge of their finances through one-on-one financial reviews that address credit card debt, student loans, housing decisions, and overall money management. For expert guidance and advice, visit http://www.nfcc.org.

Media Contact

Bruce McClary, NFCC, 202-677-4301, [email protected] , www.nfcc.org

SOURCE NFCC