The Four Core Money Scripts®

By identifying client Money Scripts, financial planners can customize advice to help clients overcome beliefs that prevent them from achieving critical financial goals.

MARIETTA, Ga. (PRWEB)

June 15, 2021

The Klontz Money Scripts Inventory-II (KMSI-II) is now available for use with clients on the DataPoints behavioral assessment platform. The KMSI-II measures client Money Scripts®, fundamental beliefs about money that impact financial decisions and wellness. By identifying client Money Scripts, financial advisors can customize advice to help clients overcome beliefs that prevent them from achieving critical financial goals. With its exclusive publication on the DataPoints platform, advisors can easily add the KMSI-II and the psychology of financial planning to their practices.

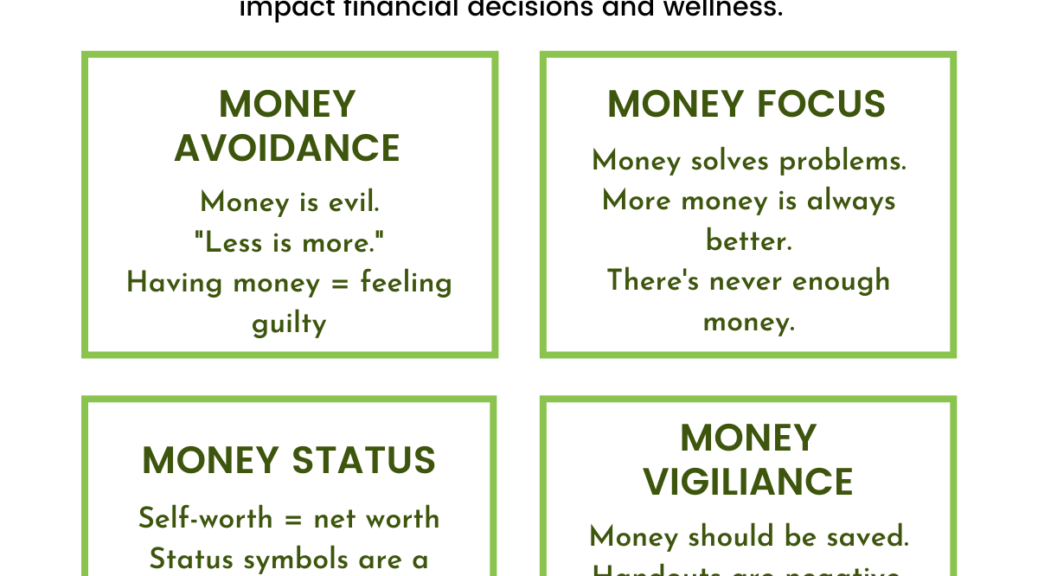

Money Scripts and the KMSI-II were created by Dr. Brad Klontz, CFP®, financial psychologist and founder of the Financial Psychology Institute. The KSMI-II provides advisors with detailed insights into each of four money scripts components, including:

- Money Avoidance – Belief that money is evil; that less money is better than more;

- Money Focus – Belief that money is the critical component in happiness; money can solve all problems; there is never enough money;

- Money Status – Belief that self-worth is tied directly to net worth; outward displays of wealth are important; money will “take care of itself”;

- Money Vigilance – Concern about saving money; belief in the value of saving and working for money; belief that financial handouts are negative.

“Money Scripts are some of the most well-researched components of a client’s financial personality. DataPoints is delighted to partner with Dr. Klontz to deliver this powerful tool to the financial services community,” says Dr. Sarah Stanley Fallaw, founder and president of DataPoints. “Understanding money personality is the first step to tailoring advice and guidance to help clients achieve their financial goals. Now financial planning firms can easily identify a client’s underlying money beliefs with DataPoints.”

The Money Scripts suite of assessments is available to firms exclusively through a subscription to the DataPoints behavioral assessment platform. The DataPoints advisor tech platform gives advisors the ability to:

- Invite clients to complete the KMSI-II

- Provide branded Money Scripts reports to clients

- Analyze change in client Money Scripts over time

- Compare Money Scripts profiles for couples

- Examine Money Scripts results across the firm

In addition to the KMSI-II, advisors who subscribe will also have access to the Financial Health Scale, a measure of overall household financial wellness. Financial therapists and clinicians may also request access to the Klontz Money Behavior Inventory, an assessment of money-related disorders including compulsive spending, financial enabling, and workaholism.

“Knowing yourself better is the best starting point for making change and improving your financial life. Now those in the financial planning fields can assess client Money Scripts and receive tailored insights to guide clients to make financial changes and improve overall financial health,” says Dr. Klontz. “Discovering and exploring Money Scripts are important steps in helping clients to achieve financial success in areas such as increasing income, building net worth, and improving financial health. Money Scripts not only provides profound insights into your clients’ unique financial psychology; the process of self-discovery is engaging and fun.”

The KMSI-II and other assessments developed by Dr. Klontz meet DataPoints strict standards for scientific rigor in psychometric test development. The KMSI-II has been researched extensively and has been found to be associated with income, net worth, credit card debt, financial behaviors, and other essential aspects of financial health. “With psychometrically sound assessments like the KMSI-II, firms can have an accurate picture of their clients’ money personality and use those insights to personalize communication, guidance, and services,” says Dr. Fallaw.

Advisors can sign up for a free, two-week trial of DataPoints to access the KMSI-II.

About DataPoints

At DataPoints, we know client mindset impacts spending, saving, and investing decisions. We’ve created a suite of tools for financial professionals to identify financial personality so that clients avoid behavioral pitfalls and achieve financial success. Our advisor tech solutions are based on more than 40 years of behavioral, consumer, and demographic data that shaped the best-selling book, The Millionaire Next Door. Learn more about DataPoints here.

Share article on social media or email: