Donate2it Counters

CHARLESTON, S.C. (PRWEB)

March 17, 2020

Crowd rising platforms have been able to help many people with financial donations from others who donate various amounts. The total donations can add up to a substantial amount that can make a difference in the lives of those that need it most.

In this time of need, many fundraising platforms are available. Some describe themselves as free. However, when a person clicks to donate, the contribution automatically adds a “15% tip” unless a donor catches it and changes it. A 2.5% credit card processing fee is also added meaning only 82.5% goes to what people are donating too. Typically, with a 45 to 75 day distribution time before a check is sent.

One particular platform, Donate2it, normally has a flat fee of 5% which is used to pay web services, insurance, licensing. Donate2it pays no dividends nor salaries. Stripe charges 2.2% for processing online transactions. There are no fees for a check contribution.

During this time, for the next few months, or as long as needed, Donate2it is dropping fees from 5% to 2.5%. With the 2.2% Stripe fee, that means that 95.3% of the money contributed will go to the cause or need.

Donate2it normally turns around the disbursement once the contribution has cleared. Usually in about 3 days.

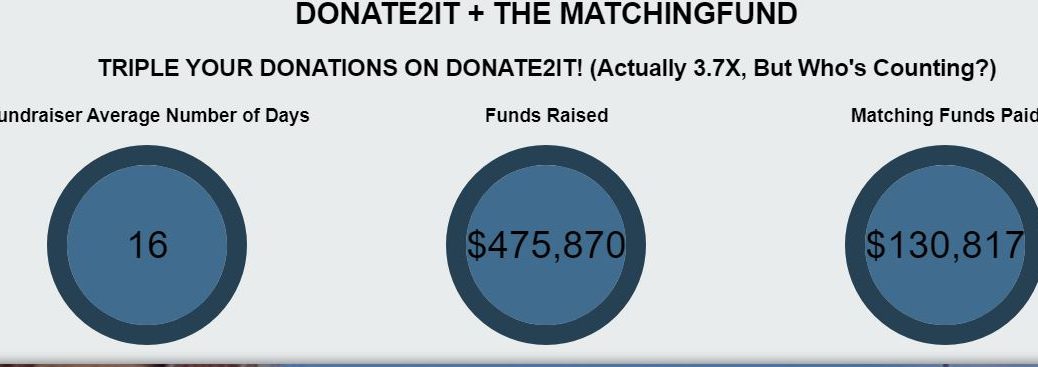

Anyone can sign up for any type of fundraiser – private or nonprofit. Current fundraisers are all for nonprofits with a match provided from the MatchingFund.org. A nonprofit can apply to receive a matching grant by signing into Donate2it and requesting a match. There is a list of very successful campaigns. Overall, since inception Donate2it with the MatchingFund has raised about $475,000. Many campaigns had a provided match. Up to $130,000 in total match has been provided so far.

The MatchingFund.org is a 501(c)(3) Charitable organization. Tax deductible donations can be made directly too TheMatchingFund.org. These donations give the board of directors the flexibility to provide Matching Funds to worthy charities and causes that might not otherwise have funds for matching donations. Donations made to individuals and other certain causes may not be tax deductible as defined by the IRS.

Share article on social media or email: