“To put it in perspective, for every $100 worth of groceries a retiree could afford in 2000, they can only buy $70 worth today,” says Mary Johnson, Social Security and Medicare Policy Analyst for The Senior Citizens League

WASHINGTON (PRWEB)

May 12, 2021

An abrupt jump in inflation in February and March wiped out a temporary improvement in the buying power of Social Security benefits, according to a new study released today by The Senior Citizens League (TSCL). The study, which compares the growth in the Social Security cost of living adjustments (COLA)s with increases in the costs of goods and services typically used by retirees found that, while consumer prices flatlined in 2020 through January 2021, retires will not be benefiting now.

The annual COLA increased Social Security benefits in January of 2021 by just 1.3 percent. While the lack of inflation in 2020 did improve the buying power of Social Security benefits by 2 percentage points through the month of January 2021 — from a loss in buying power of 30 percent to a loss of 28 percent — that improvement was completely wiped out by soaring inflation in February and March of this year,” says Mary Johnson, a Social Security policy analyst for The Senior Citizens League (TSCL).

The new study found that consumer price data through March 2021 indicate that Social Security benefits have (once again) lost 30 percent of their buying power and “that loss of buying power could grow deeper in 2021, should the current inflationary trends continue,” Johnson says.

The Senior Citizens League, which has been conducting the study for 12 years, typically looks at data from the 12 – month period of January of the previous year to January of the current year. “But we are in an aggressive inflation pattern that I haven’t seen previously,” Johnson says. “We felt compelled to include this data in our study findings for 2021, in order to learn how this abrupt rise of inflation affects the buying power of Social Security benefits today,” she adds.

This study, looks at 39 expenditures that are typical for people age 65 and up, comparing the growth in the prices of these goods and services to the growth in the annual COLAs. Based on consumer price index data through April 2021, it appears that the next COLA will be considerably higher in 2022. The Senior Citizens League (TSCL) is forecasting that the 2022 COLA could be 4.7%, making it the highest since 2009. But with such a high level of inflation volatility, this estimate could change several times before the COLA is announced in October 2021.

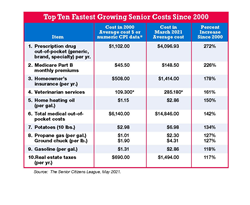

Since 2000, COLAs have increased Social Security benefits a total of 55 percent, yet typical senior expenses through March 2021 grew 101.7%. The average Social Security benefit in 2000 was $816 per month. That benefit grew to $1,262.40 by 2021 due to COLA increases. However, because retiree costs are rising at a far more rapid pace than the COLA, this study found that a Social Security benefit of $1,645.60 per month in 2020 would be required just to maintain the same level of buying power as $816 had in 2000.

The study looks at the costs of goods and services that are typically purchased by most Social Security recipients. This includes expenditures such as the Medicare Part B premium, which is not measured by the index currently used to calculate the COLA, yet is one of the fastest growing costs that retirees face. Of the 39 items analyzed, 27 exceeded the COLA while 14 were lower than the COLA. “This study illustrates why legislation is needed to provide a more fair and adequate COLA,” Johnson says. “To put it in perspective, for every $100 worth of groceries a retiree could afford in 2000, they can only buy $70 worth today,” Johnson adds.

To help protect the buying power of benefits, TSCL supports legislation that would provide a modest boost in benefits and base COLAs on the Consumer Price Index for the Elderly (CPI-E) or guarantee a COLA no lower than 3 percent. To learn more, visit http://www.SeniorsLeague.org.

###

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit http://www.SeniorsLeague.org for more information.

ALSO AVAILABLE TO JOURNALISTS: Social Security Loss of Buying Power report including study methodology available for download. The Senior Citizens League 2021 Loss of Buying Power Study

Share article on social media or email: