Sheer buying power allows you to wrangle favorable pricing, but costs still accrue quickly when matters are fluid, and the budget isn’t being closely monitored.

LONDON (PRWEB)

June 07, 2021

Private equity (PE) firms spend millions annually with law firms to manage high-end legal matters such as fundraising, merger and acquisition (M&A) transactions and litigation – but not all private capital firms are effective at managing those costs. That’s according to a new report by Apperio titled, Scale vs. agility in private equity: Mid-sized PE firms are edging out their larger competitors with better management of legal expenses.

While large PE firms, which this report classifies as those with greater than $10 billion in assets under management (AUM), glean some benefit from their volume of spending on legal services, the study found mid-sized PE firms are generally more proactive about legal spend management. Mid-sized PE firms, those with between $3 billion and $10 billion in AUM, put significantly more effort into process and technology to control the cost of outside counsel.

“This study demonstrates the limitations of relying solely on scale to control the growth in cost of legal services,” said Apperio Founder and CEO Nicholas d’Adhemar who is both a former lawyer and PE investment manager. “Sheer buying power allows you to wrangle favorable pricing, but costs still accrue quickly when matters are fluid, and the budget isn’t being closely monitored.”

Some of the key findings in the study include:

● Scale in legal spending has certain advantages. Large PE firms outspend mid-sized firms on legal services. That does provide some advantages with legal service suppliers in certain matters. For example, large PE firms spend less on legal as a percentage per M&A transaction than mid-sized firms even as they tend to work on larger deals that cost more overall to execute.

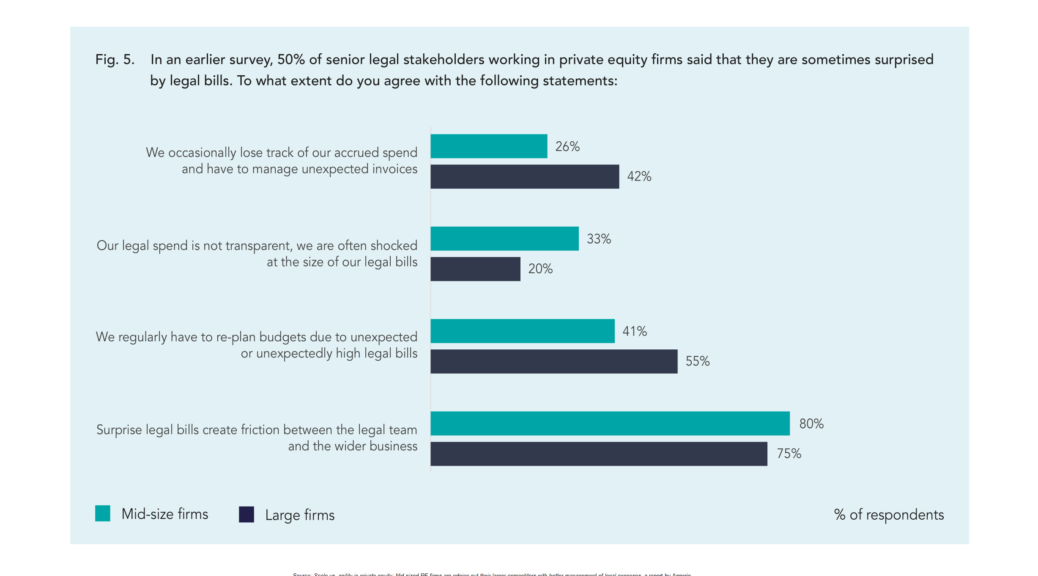

● One in five large PE firms are “often shocked” by the size of legal invoices. That shock has effects on the internal organizational dynamics that are problematic. More than half (55%) say higher than expected invoices cause them to reforecast budgets, which leads to widespread internal friction among legal, finance and investment teams.

● Some large PE firms make no effort to control legal costs. About one in five large PE firms (22%) say they make no effort to actively manage legal costs compared to just 4% of mid-sized firms. Seven in 10 large PE firms reported they were billed for legal work that was, in hindsight, considered unnecessary or redundant.

● Mid-sized PE firms place a sharper focus on spending. The difference in legal spend management approaches between mid-sized and large PE firms becomes more pronounced in a comparison of business processes. For example, 74% of mid-sized PE firms enforce a formal budget approval process for new matters, compared to just 55% of large PE firms.

● Interest grows in specialized legal spend technology. The majority of both mid-sized (70%) and large PE firms (65%) are reliant on manual data collection and spreadsheets for managing millions in annual legal spend. However, that reliance is down from 91% compared to an earlier survey published in July 2020. Across PE firms of all sizes, most either have specialized legal spend management software in place or have plans to introduce it within their organization.

“It’s important to note that PE firms of all sizes recognize this is a material concern,” added d’Adhemar. “Nearly three quarters of mid-sized PE firms (72%) and large firms (77%) say legal spend optimization is a priority for their organization in 2021.”

The report points to EQT, one of the world’s largest private investment firms, as a model to follow. In a case study, EQT noted, before implementing legal spend management, there could be a gap of weeks between law firm status and time-entry updates – and fees would suddenly and unexpectedly jump in that period.

Now their legal spend management efforts enable them to see exactly what’s happening without having to ask law firms for such granular updates. In turn, this provides the opportunity to prevent costs from mushrooming.

About the Report

This report is a new analysis based on a specific data set from an independent survey of PE firms of all sizes. A complimentary copy of the report is freely available for download here – or simply email marketing@apperio.com to request a copy.

# # #

About Apperio

Apperio is a legal spend analytics and matter tracking platform which effectively transforms how corporate legal departments function, bringing clarity, control and confidence to their operations. The platform provides complete real-time certainty on legal spend, aggregating data from all connected law firms and providing consistent, up-to-date information on all work-in-progress (WIP) and billed legal matters. Apperio visually represents for legal teams, finance and other corporate departments exactly what has and will be spent on legal fees, accurately measuring the performance of its external law firms. Quick to install, cloud-based Apperio requires no on-site IT team. Currently, the platform is used daily by more than 50 in-house legal teams including Epiris, EQT, Network Rail, Royal London, Monzo and Farfetch.

Apperio is based in London, England. For more information, please visit Apperio.com or follow Apperio on LinkedIn or Twitter.

Media Contact:

Frank Strong

for Apperio, Ltd.

+1 202-352-5920

media@apperio.com

Share article on social media or email: