One of the 9 exhibits included in this research report

Authentication using biometrics is rapidly being adopted, in part because of hardware manufacturers enabling its use, and in part because the standard for authentication has increased the ease with which authenticators can utilize mobile biometrics over the web and decrease friction for consumers.

BOSTON (PRWEB)

April 30, 2020

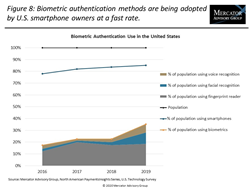

In recent years, user authentication based on biometrics (biometric authentication) has become a new method for consumers to open their smartphones and select mobile apps. Mercator market research indicates biometric use is increasing even as consumers adopt a greater variety of methods choosing among fingerprint, facial recognition, and voice recognition. Biometrics are important because they utilize new mobile security hardware and software to revamp authentication, lower the risk of fraud, address the mandates of the European Union’s revised Payment Services Directive (PSD2), and induce changes in consumer behavior.

Mercator Advisory Group’s latest research report, Biometrics: Driven by Standardized Authentication, Adopted by Consumers, provides consumer sentiment, adoption rates, and forecasts on biometric authentication methods, both to unlock smartphones and for payment authentication. Additionally the report examines the FIDO Alliance, discussing how it has standardized authentication and the implications for biometrics and payments.

“Authentication using biometrics is rapidly being adopted by consumers, in part as a result of hardware manufacturers enabling its use, and in part because the standard for authentication created by the FIDO Alliance has increased the ease with which authenticators can utilize the mobile biometrics over the web and decrease authentication friction for consumers,” comments David Nelyubin, Research Analyst at Mercator Advisory Group and co-author of the report.

Highlights of the report include:

-

Historical data, forecast, and analysis (2013–2024) of consumer use of biometric authentication methods (facial recognition, voice recognition, fingerprint) in total and by smartphone brand, based on Mercator Advisory Groups annual survey of 3000 U.S. adults. - Biometrics methods for payment authentication (2016–2019) preferred by U.S. payment app users and analysis of results.

- Explanation of multifactor biometrics and the role that biometric methods play in the overall authentication process.

- Discussion of FIDO Alliance standardizing authentication, the effects on biometrics, and implications for payments and payments players and authentication in general.

This research report has 16 pages and 9 exhibits.

Companies and other organizations mentioned in this report include: Android, Apple, BlackBerry, Google, FIDO Alliance, Microsoft, Mozilla Foundation, NXP, PayPal, Samsung, W3C, and Yubico.

Members of Mercator Advisory Group’s Emerging Technologies Advisory Service and Global Payments Advisory Service have access to this report. Members of the Emerging Technologies service also have access to the service’s upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

For more information and media inquiries, please call Mercator Advisory Group’s main line: 1-781-419-1700, send e-mail to info@mercatoradvisorygroup.com.

For free industry news, opinions, research, company information and more visit us at http://www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world’s largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Share article on social media or email: